9. An Asset Pricing Problem#

GPU

This lecture was built using a machine with JAX installed and access to a GPU.

To run this lecture on Google Colab, click on the “play” icon top right, select Colab, and set the runtime environment to include a GPU.

To run this lecture on your own machine, you need to install Google JAX.

9.1. Overview#

In this lecture we consider some asset pricing problems and use them to illustrate some foundations of JAX programming.

The main difference from the lecture Asset Pricing: The Lucas Asset Pricing Model, which also considers asset prices, is that the the state spaces will be discrete and multi-dimensional.

Most of the heavy lifting is done through routines from linear algebra.

Along the way, we will show how to solve some memory-intensive problems with large state spaces.

We do this using elegant techniques made available by JAX, involving the use of linear operators to avoid instantiating large matrices.

If you wish to skip all motivation and move straight to the first equation we plan to solve, you can jump to (9.13).

The code outputs below are generated by machine connected to the following GPU

!nvidia-smi

Mon May 19 04:15:36 2025

+-----------------------------------------------------------------------------------------+

| NVIDIA-SMI 575.51.03 Driver Version: 575.51.03 CUDA Version: 12.9 |

|-----------------------------------------+------------------------+----------------------+

| GPU Name Persistence-M | Bus-Id Disp.A | Volatile Uncorr. ECC |

| Fan Temp Perf Pwr:Usage/Cap | Memory-Usage | GPU-Util Compute M. |

| | | MIG M. |

|=========================================+========================+======================|

| 0 Tesla T4 Off | 00000000:00:1E.0 Off | 0 |

| N/A 32C P0 32W / 70W | 0MiB / 15360MiB | 0% Default |

| | | N/A |

+-----------------------------------------+------------------------+----------------------+

+-----------------------------------------------------------------------------------------+

| Processes: |

| GPU GI CI PID Type Process name GPU Memory |

| ID ID Usage |

|=========================================================================================|

| No running processes found |

+-----------------------------------------------------------------------------------------+

In addition to JAX and Anaconda, this lecture will need the following libraries:

!pip install quantecon

Show code cell output

Requirement already satisfied: quantecon in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (0.8.0)

Requirement already satisfied: numba>=0.49.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (0.60.0)

Requirement already satisfied: numpy>=1.17.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.26.4)

Requirement already satisfied: requests in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (2.32.3)

Requirement already satisfied: scipy>=1.5.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.13.1)

Requirement already satisfied: sympy in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from quantecon) (1.13.2)

Requirement already satisfied: llvmlite<0.44,>=0.43.0dev0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from numba>=0.49.0->quantecon) (0.43.0)

Requirement already satisfied: charset-normalizer<4,>=2 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.3.2)

Requirement already satisfied: idna<4,>=2.5 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (3.7)

Requirement already satisfied: urllib3<3,>=1.21.1 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2.2.3)

Requirement already satisfied: certifi>=2017.4.17 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from requests->quantecon) (2024.8.30)

Requirement already satisfied: mpmath<1.4,>=1.1.0 in /home/runner/miniconda3/envs/quantecon/lib/python3.12/site-packages (from sympy->quantecon) (1.3.0)

Below we use the following imports

import scipy

import quantecon as qe

import matplotlib.pyplot as plt

import numpy as np

import jax

import jax.numpy as jnp

from collections import namedtuple

from time import time

We will use 64 bit floats with JAX in order to increase precision.

jax.config.update("jax_enable_x64", True)

9.2. Pricing a single payoff#

Suppose, at time

The simplest way to price this asset is to use “risk-neutral” asset pricing, which

asserts that the price of the asset at time

Here

Roughly speaking, (9.1) says that the cost (i.e., price) equals expected benefit.

The discount factor is introduced because most people prefer payments now to payments in the future.

One problem with this very simple model is that it does not take into account attitudes to risk.

For example, investors often demand higher rates of return for holding risky assets.

This feature of asset prices cannot be captured by risk neutral pricing.

Hence we modify (9.1) to

In this expression,

In essence, allowing discounting to become a random variable gives us the flexibility to combine temporal discounting and attitudes to risk.

We leave further discussion to other lectures because our aim is to move to the computational problem.

9.3. Pricing a cash flow#

Now let’s try to price an asset like a share, which delivers a cash flow

We will call these payoffs “dividends”.

If we buy the share, hold it for one period and sell it again, we receive one

dividend and our payoff is

Therefore, by (9.2), the price should be

Because prices generally grow over time, which complicates analysis, it will be

easier for us to solve for the price-dividend ratio

Let’s write down an expression that this ratio should satisfy.

We can divide both sides of (9.3) by

We can also write this as

where

is the growth rate of dividends.

Our aim is to solve (9.5) but before that we need to specify

the stochastic discount factor

the growth rate of dividends

9.4. Choosing the stochastic discount factor#

We will adopt the stochastic discount factor described in Asset Pricing: The Lucas Asset Pricing Model, which has the form

where

For utility, we’ll assume the constant relative risk aversion (CRRA) specification

Inserting the CRRA specification into (9.6) and letting

the growth rate rate of consumption, we obtain

9.5. Solving for the price-dividend ratio#

Substituting (9.8) into (9.5) gives the price-dividend ratio formula

We assume there is a Markov chain

Here

We can think of

We let

We guess that

This means that

By (9.9), the unknown function

where

Since the shocks

We use the following property of lognormal distributions: if

This yields

Conditioning on

for all

Suppose

Then we can think of

for

Equivalently, we can write

where

Rewriting (9.14) in vector form yields

Notice that (9.16) can be written as

The Neumann series lemma tells us that

whenever

Once we specify

obtain

check the spectral radius condition

compute the solution via (9.17).

9.6. Code#

We will use the power iteration algorithm to check the spectral radius condition.

The function below computes the spectral radius of A.

def power_iteration_sr(A, num_iterations=15, seed=1234):

" Estimates the spectral radius of A via power iteration. "

# Initialize

key = jax.random.PRNGKey(seed)

b_k = jax.random.normal(key, (A.shape[1],))

sr = 0

for _ in range(num_iterations):

# calculate the matrix-by-vector product Ab

b_k1 = jnp.dot(A, b_k)

# calculate the norm

b_k1_norm = jnp.linalg.norm(b_k1)

# Record the current estimate of the spectral radius

sr = jnp.sum(b_k1 * b_k)/jnp.sum(b_k * b_k)

# re-normalize the vector and continue

b_k = b_k1 / b_k1_norm

return sr

power_iteration_sr = jax.jit(power_iteration_sr)

The next function verifies that the spectral radius of a given matrix is

def test_stability(Q):

"""

Assert that the spectral radius of matrix Q is < 1.

"""

sr = power_iteration_sr(Q)

assert sr < 1, f"Spectral radius condition failed with radius = {sr}"

In what follows we assume that

where

To discretize this process we use QuantEcon.py’s tauchen function.

Below we write a function called create_model() that returns a namedtuple storing the relevant parameters and arrays.

Model = namedtuple('Model',

('P', 'S', 'β', 'γ', 'μ_c', 'μ_d', 'σ_c', 'σ_d'))

def create_model(N=100, # size of state space for Markov chain

ρ=0.9, # persistence parameter for Markov chain

σ=0.01, # persistence parameter for Markov chain

β=0.98, # discount factor

γ=2.5, # coefficient of risk aversion

μ_c=0.01, # mean growth of consumption

μ_d=0.01, # mean growth of dividends

σ_c=0.02, # consumption volatility

σ_d=0.04): # dividend volatility

# Create the state process

mc = qe.tauchen(N, ρ, σ)

S = mc.state_values

P = mc.P

# Shift arrays to the device

S, P = map(jax.device_put, (S, P))

# Return the namedtuple

return Model(P=P, S=S, β=β, γ=γ, μ_c=μ_c, μ_d=μ_d, σ_c=σ_c, σ_d=σ_d)

Our first step is to construct the matrix

Here’s a function that does this using loops.

def compute_K_loop(model):

# unpack

P, S, β, γ, μ_c, μ_d, σ_c, σ_d = model

N = len(S)

K = np.empty((N, N))

a = μ_d - γ * μ_c

for i, x in enumerate(S):

for j, y in enumerate(S):

e = np.exp(a + (1 - γ) * x + (σ_d**2 + γ**2 * σ_c**2) / 2)

K[i, j] = β * e * P[i, j]

return K

To exploit the parallelization capabilities of JAX, let’s also write a vectorized (i.e., loop-free) implementation.

def compute_K(model):

# unpack

P, S, β, γ, μ_c, μ_d, σ_c, σ_d = model

N = len(S)

# Reshape and multiply pointwise using broadcasting

x = np.reshape(S, (N, 1))

a = μ_d - γ * μ_c

e = np.exp(a + (1 - γ) * x + (σ_d**2 + γ**2 * σ_c**2) / 2)

K = β * e * P

return K

These two functions produce the same output:

model = create_model(N=10)

K1 = compute_K(model)

K2 = compute_K_loop(model)

np.allclose(K1, K2)

True

Now we can compute the price-dividend ratio:

def price_dividend_ratio(model, test_stable=True):

"""

Computes the price-dividend ratio of the asset.

Parameters

----------

model: an instance of Model

contains primitives

Returns

-------

v : array_like

price-dividend ratio

"""

K = compute_K(model)

N = len(model.S)

if test_stable:

test_stability(K)

# Compute v

I = np.identity(N)

ones_vec = np.ones(N)

v = np.linalg.solve(I - K, K @ ones_vec)

return v

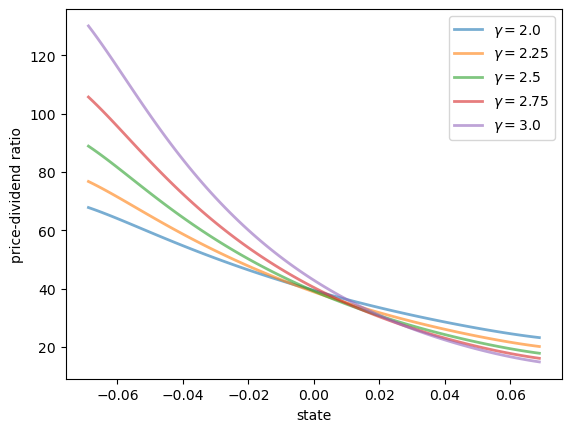

Here’s a plot of

model = create_model()

S = model.S

γs = np.linspace(2.0, 3.0, 5)

fig, ax = plt.subplots()

for γ in γs:

model = create_model(γ=γ)

v = price_dividend_ratio(model)

ax.plot(S, v, lw=2, alpha=0.6, label=rf"$\gamma = {γ}$")

ax.set_ylabel("price-dividend ratio")

ax.set_xlabel("state")

ax.legend(loc='upper right')

plt.show()

Notice that

This is because, with a positively correlated state process, higher states indicate higher future consumption growth.

With the stochastic discount factor (9.8), higher growth decreases the discount factor, lowering the weight placed on future dividends.

9.7. An Extended Example#

One problem with the last set is that volatility is constant through time (i.e.,

In reality, financial markets and growth rates of macroeconomic variables exhibit bursts of volatility.

To accommodate this, we now develop a stochastic volatility model.

To begin, suppose that consumption and dividends grow as follows.

where

We assume that

Here

Let

We call

Modifying (9.10) to accommodate the new growth specifications,

we find that

where, as before,

Conditioning on state

As before, we integrate out the independent shocks and use the rules for expectations of lognormals to obtain

Let

where

With this notation, we can write (9.20) more explicitly as

Let’s now write the state using indices, with

Then (9.21) becomes

One way to understand this is to reshape

Then we can write (9.22) as

Provided that the spectral radius condition

9.8. Numpy Version#

Our first implementation will be in NumPy.

Once we have a NumPy version working, we will convert it to JAX and check the difference in the run times.

The code block below provides a function called create_sv_model() that returns a namedtuple containing arrays and other data that form the primitives of the problem.

It assumes that

SVModel = namedtuple('SVModel',

('P', 'hc_grid',

'Q', 'hd_grid',

'R', 'z_grid',

'β', 'γ', 'bar_σ', 'μ_c', 'μ_d'))

def create_sv_model(β=0.98, # discount factor

γ=2.5, # coefficient of risk aversion

I=14, # size of state space for h_c

ρ_c=0.9, # persistence parameter for h_c

σ_c=0.01, # volatility parameter for h_c

J=14, # size of state space for h_d

ρ_d=0.9, # persistence parameter for h_d

σ_d=0.01, # volatility parameter for h_d

K=14, # size of state space for z

bar_σ=0.01, # volatility scaling parameter

ρ_z=0.9, # persistence parameter for z

σ_z=0.01, # persistence parameter for z

μ_c=0.001, # mean growth of consumption

μ_d=0.005): # mean growth of dividends

mc = qe.tauchen(I, ρ_c, σ_c)

hc_grid = mc.state_values

P = mc.P

mc = qe.tauchen(J, ρ_d, σ_d)

hd_grid = mc.state_values

Q = mc.P

mc = qe.tauchen(K, ρ_z, σ_z)

z_grid = mc.state_values

R = mc.P

return SVModel(P=P, hc_grid=hc_grid,

Q=Q, hd_grid=hd_grid,

R=R, z_grid=z_grid,

β=β, γ=γ, bar_σ=bar_σ, μ_c=μ_c, μ_d=μ_d)

Now we provide a function to compute the matrix

def compute_A(sv_model):

# Set up

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

I, J, K = len(hc_grid), len(hd_grid), len(z_grid)

N = I * J * K

# Reshape and broadcast over (i, j, k, i', j', k')

hc = np.reshape(hc_grid, (I, 1, 1, 1, 1, 1))

hd = np.reshape(hd_grid, (1, J, 1, 1, 1, 1))

z = np.reshape(z_grid, (1, 1, K, 1, 1, 1))

P = np.reshape(P, (I, 1, 1, I, 1, 1))

Q = np.reshape(Q, (1, J, 1, 1, J, 1))

R = np.reshape(R, (1, 1, K, 1, 1, K))

# Compute A and then reshape to create a matrix

a = μ_d - γ * μ_c

b = bar_σ**2 * (np.exp(2 * hd) + γ**2 * np.exp(2 * hc)) / 2

κ = np.exp(a + (1 - γ) * z + b)

A = β * κ * P * Q * R

A = np.reshape(A, (N, N))

return A

Here’s our function to compute the price-dividend ratio for the stochastic volatility model.

def sv_pd_ratio(sv_model, test_stable=True):

"""

Computes the price-dividend ratio of the asset for the stochastic volatility

model.

Parameters

----------

sv_model: an instance of Model

contains primitives

Returns

-------

v : array_like

price-dividend ratio

"""

# unpack

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

I, J, K = len(hc_grid), len(hd_grid), len(z_grid)

N = I * J * K

A = compute_A(sv_model)

# Make sure that a unique solution exists

if test_stable:

test_stability(A)

# Compute v

ones_array = np.ones(N)

Id = np.identity(N)

v = scipy.linalg.solve(Id - A, A @ ones_array)

# Reshape into an array of the form v[i, j, k]

v = np.reshape(v, (I, J, K))

return v

Let’s create an instance of the model and solve it.

sv_model = create_sv_model()

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

Let’s run it to compile.

start = time()

v = sv_pd_ratio(sv_model)

numpy_with_compile = time() - start

print("Numpy compile plus execution time = ", numpy_with_compile)

Numpy compile plus execution time = 0.8721084594726562

Let’s run it again to remove the compile.

start = time()

v = sv_pd_ratio(sv_model)

numpy_without_compile = time() - start

print("Numpy execution time = ", numpy_without_compile)

Numpy execution time = 0.28946471214294434

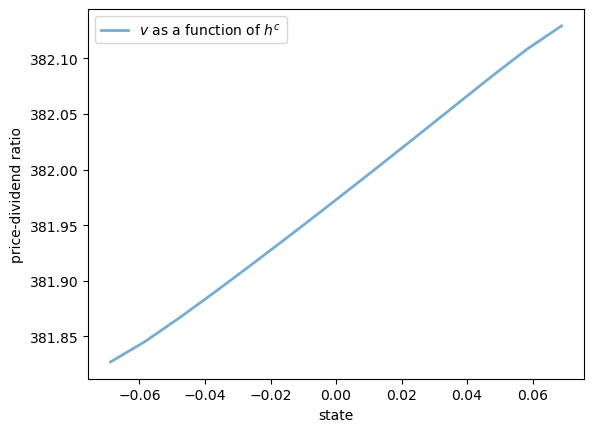

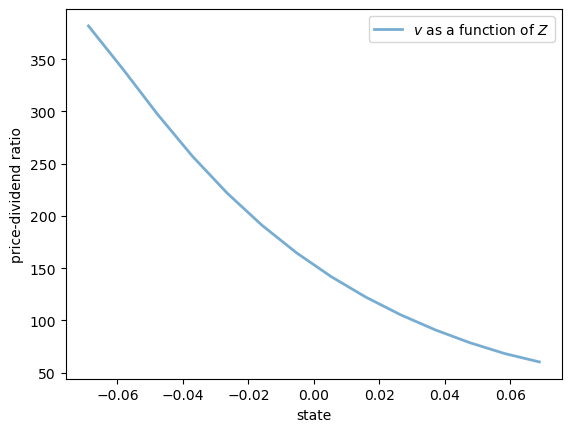

Here are some plots of the solution

fig, ax = plt.subplots()

ax.plot(hc_grid, v[:, 0, 0], lw=2, alpha=0.6, label="$v$ as a function of $h^c$")

ax.set_ylabel("price-dividend ratio")

ax.set_xlabel("state")

ax.legend()

plt.show()

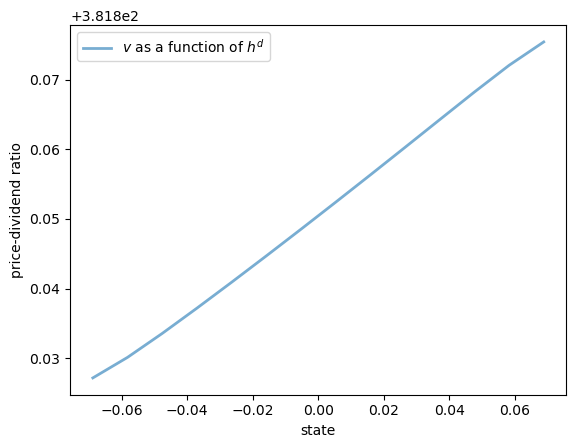

fig, ax = plt.subplots()

ax.plot(hd_grid, v[0, :, 0], lw=2, alpha=0.6, label="$v$ as a function of $h^d$")

ax.set_ylabel("price-dividend ratio")

ax.set_xlabel("state")

ax.legend()

plt.show()

9.9. JAX Version#

Now let’s write a JAX version that is a simple transformation of the NumPy version.

(Below we will write a more efficient version using JAX’s ability to work with linear operators.)

def create_sv_model_jax(sv_model): # mean growth of dividends

# Take the contents of a NumPy sv_model instance

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

# Shift the arrays to the device (GPU if available)

hc_grid, hd_grid, z_grid = map(jax.device_put, (hc_grid, hd_grid, z_grid))

P, Q, R = map(jax.device_put, (P, Q, R))

# Create a new instance and return it

return SVModel(P=P, hc_grid=hc_grid,

Q=Q, hd_grid=hd_grid,

R=R, z_grid=z_grid,

β=β, γ=γ, bar_σ=bar_σ, μ_c=μ_c, μ_d=μ_d)

Here’s a function to compute

We include the extra argument shapes to help the compiler understand the size of the arrays.

This is important when we JIT-compile the function below.

def compute_A_jax(sv_model, shapes):

# Set up

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

I, J, K = shapes

N = I * J * K

# Reshape and broadcast over (i, j, k, i', j', k')

hc = jnp.reshape(hc_grid, (I, 1, 1, 1, 1, 1))

hd = jnp.reshape(hd_grid, (1, J, 1, 1, 1, 1))

z = jnp.reshape(z_grid, (1, 1, K, 1, 1, 1))

P = jnp.reshape(P, (I, 1, 1, I, 1, 1))

Q = jnp.reshape(Q, (1, J, 1, 1, J, 1))

R = jnp.reshape(R, (1, 1, K, 1, 1, K))

# Compute A and then reshape to create a matrix

a = μ_d - γ * μ_c

b = bar_σ**2 * (jnp.exp(2 * hd) + γ**2 * jnp.exp(2 * hc)) / 2

κ = jnp.exp(a + (1 - γ) * z + b)

A = β * κ * P * Q * R

A = jnp.reshape(A, (N, N))

return A

Here’s the function that computes the solution.

def sv_pd_ratio_jax(sv_model, shapes):

"""

Computes the price-dividend ratio of the asset for the stochastic volatility

model.

Parameters

----------

sv_model: an instance of Model

contains primitives

Returns

-------

v : array_like

price-dividend ratio

"""

# unpack

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

I, J, K = len(hc_grid), len(hd_grid), len(z_grid)

shapes = I, J, K

N = I * J * K

A = compute_A_jax(sv_model, shapes)

# Compute v, reshape and return

ones_array = jnp.ones(N)

Id = jnp.identity(N)

v = jax.scipy.linalg.solve(Id - A, A @ ones_array)

return jnp.reshape(v, (I, J, K))

Now let’s target these functions for JIT-compilation, while using static_argnums to indicate that the function will need to be recompiled when shapes changes.

compute_A_jax = jax.jit(compute_A_jax, static_argnums=(1,))

sv_pd_ratio_jax = jax.jit(sv_pd_ratio_jax, static_argnums=(1,))

sv_model = create_sv_model()

sv_model_jax = create_sv_model_jax(sv_model)

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model_jax

shapes = len(hc_grid), len(hd_grid), len(z_grid)

Let’s see how long it takes to run with compile time included.

start = time()

v_jax = sv_pd_ratio_jax(sv_model_jax, shapes).block_until_ready()

jnp_with_compile = time() - start

print("JAX compile plus execution time = ", jnp_with_compile)

JAX compile plus execution time = 0.6433587074279785

And now let’s see without compile time.

start = time()

v_jax = sv_pd_ratio_jax(sv_model_jax, shapes).block_until_ready()

jnp_without_compile = time() - start

print("JAX execution time = ", jnp_without_compile)

JAX execution time = 0.11757493019104004

Here’s the ratio of times:

jnp_without_compile / numpy_without_compile

0.4061805299879829

Let’s check that the NumPy and JAX versions realize the same solution.

v = jax.device_put(v)

print(jnp.allclose(v, v_jax))

True

9.10. A memory-efficient JAX version#

One problem with the code above is that we instantiate a matrix of size

This quickly becomes impossible as

Fortunately, JAX makes it possible to solve for the price-dividend ratio without instantiating this large matrix.

The first step is to think of

def A(g, sv_model, shapes):

# Set up

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

I, J, K = shapes

# Reshape and broadcast over (i, j, k, i', j', k')

hc = jnp.reshape(hc_grid, (I, 1, 1, 1, 1, 1))

hd = jnp.reshape(hd_grid, (1, J, 1, 1, 1, 1))

z = jnp.reshape(z_grid, (1, 1, K, 1, 1, 1))

P = jnp.reshape(P, (I, 1, 1, I, 1, 1))

Q = jnp.reshape(Q, (1, J, 1, 1, J, 1))

R = jnp.reshape(R, (1, 1, K, 1, 1, K))

g = jnp.reshape(g, (1, 1, 1, I, J, K))

a = μ_d - γ * μ_c

b = bar_σ**2 * (jnp.exp(2 * hd) + γ**2 * jnp.exp(2 * hc)) / 2

κ = jnp.exp(a + (1 - γ) * z + b)

A = β * κ * P * Q * R

Ag = jnp.sum(A * g, axis=(3, 4, 5))

return Ag

Now we write a version of the solution function for the price-dividend ratio

that acts directly on the linear operator A.

def sv_pd_ratio_linop(sv_model, shapes):

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model

I, J, K = shapes

ones_array = jnp.ones((I, J, K))

# Set up the operator g -> (I - A) g

J = lambda g: g - A(g, sv_model, shapes)

# Solve v = (I - A)^{-1} A 1

A1 = A(ones_array, sv_model, shapes)

# Apply an iterative solver that works for linear operators

v = jax.scipy.sparse.linalg.bicgstab(J, A1)[0]

return v

Let’s target these functions for JIT compilation.

A = jax.jit(A, static_argnums=(2,))

sv_pd_ratio_linop = jax.jit(sv_pd_ratio_linop, static_argnums=(1,))

Let’s time the solution with compile time included.

start = time()

v_jax_linop = sv_pd_ratio_linop(sv_model, shapes).block_until_ready()

jnp_linop_with_compile = time() - start

print("JAX compile plus execution time = ", jnp_linop_with_compile)

JAX compile plus execution time = 0.5621523857116699

And now let’s see without compile time.

start = time()

v_jax_linop = sv_pd_ratio_linop(sv_model, shapes).block_until_ready()

jnp_linop_without_compile = time() - start

print("JAX execution time = ", jnp_linop_without_compile)

JAX execution time = 0.006590127944946289

Let’s verify the solution again:

print(jnp.allclose(v, v_jax_linop))

True

Here’s the ratio of times between memory-efficient and direct version:

jnp_linop_without_compile / jnp_without_compile

0.05605045169270701

The speed is somewhat faster and, moreover, we can now work with much larger grids.

Here’s a moderately large example, where the state space has 15,625 elements.

sv_model = create_sv_model(I=25, J=25, K=25)

sv_model_jax = create_sv_model_jax(sv_model)

P, hc_grid, Q, hd_grid, R, z_grid, β, γ, bar_σ, μ_c, μ_d = sv_model_jax

shapes = len(hc_grid), len(hd_grid), len(z_grid)

%time _ = sv_pd_ratio_linop(sv_model_jax, shapes).block_until_ready()

%time _ = sv_pd_ratio_linop(sv_model_jax, shapes).block_until_ready()

CPU times: user 642 ms, sys: 12.2 ms, total: 654 ms

Wall time: 775 ms

CPU times: user 172 ms, sys: 26 μs, total: 172 ms

Wall time: 171 ms

The solution is computed relatively quickly and without memory issues.

Readers will find that they can push these numbers further, although we refrain from doing so here.